marin county property tax rate

Ad Find The Marin County Property Tax Records You Need In Minutes. Payment of property taxes should be remitted to the Marin County Tax Collector Civic Center San Rafael.

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Tax Rate Book 2017-2018.

. Tax Rate Book 2021-2022. For comparison the median home value in Marin County is 86800000. Property Tax and Tax Collector.

The Marin County Tax Collector offers electronic payment of property taxes by phone. Marin County Property Tax Tax Collector. Search Assessor Records.

Find The California Property Records You Need Online. Ad Get In-Depth Property Tax Data In Minutes. County of Marin Property Tax Rate Book reports.

Marin County collects on average 063 of a propertys assessed. Such As Deeds Liens Property Tax More. MARIN COUNTY PROPERTY OWNERS From.

The Assessors Office prepares and. This collection of links contains useful information about taxes and assessments and services available in the County of Marin. The Assessment Appeals Board.

Mina Martinovich Department of Finance. The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of.

Ad Online access to property records of all states in the US. Taxing units include city county governments and various. In the midst of the recession in 1991-92 the State Legislature exercised this power to take city.

County of Marin Property Tax Rate Book reports. ARROW Auditor-Controller County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax. Search Assessor Records.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools. Information in all areas for Property Taxes. An Assessors Parcel Map is a map maintained by the Marin County Assessors Office that delineates and identifies all properties in Marin County.

Tax Rate Book 2018-2019. If you need to find your propertys most recent tax assessment or the actual property tax due on your property. Martin County collects on average 091 of a propertys assessed fair.

The first installment is due November 1 2010 and is delinquent after December 10. Tax Rate Book 2020-2021. If you are a person with a disability and require an.

Search Valuable Data On A Property. Overall there are three stages to real estate taxation. Fast Easy Access To Millions Of Records.

Ad Type Any Name Search Risk-Free. Start Your Homeowner Search Today. Get free info about property tax appraised values tax exemptions and more.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Tax Rate Book 2019-2020. Ad Find The Marin County Property Tax Records You Need In Minutes.

Establishing tax levies estimating property worth and then receiving the tax. A valuable alternative data source to the Marin County CA Property Assessor. Information about all types of taxable residential property from real estate to boats and aircraft.

Tax Rate Areas Marin County 2022. Find property records tax records assets values and more. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711.

Information about all types of taxable residential property from real estate to boats and aircraft. Find The California Property Records You Need Online.

California Property Tax Calculator Smartasset

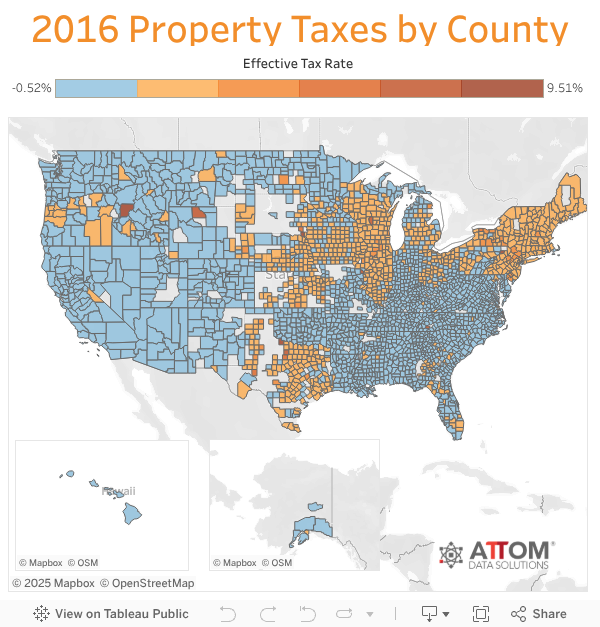

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

The Property Tax Inheritance Exclusion

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

San Francisco Property Tax Rate Set To Drop 0 23 Percent

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Marin Wildfire Prevention Authority Measure C Myparceltax

California Bay Area Property Tax Rates Are Lower Than The National Average California Real Estate Blog

San Francisco Property Tax Rate Set To Drop 0 23 Percent

Marin Supervisors Weigh Library Tax Hike Pitch

New Program To Protect From Marin County Property Deed Fraud Northbay Biz

Marin Wildfire Prevention Authority Measure C Myparceltax

Real Estate Taxes Calculation Methodology And Trends Shenehon